How AI is Reshaping SaaS Revenue Models

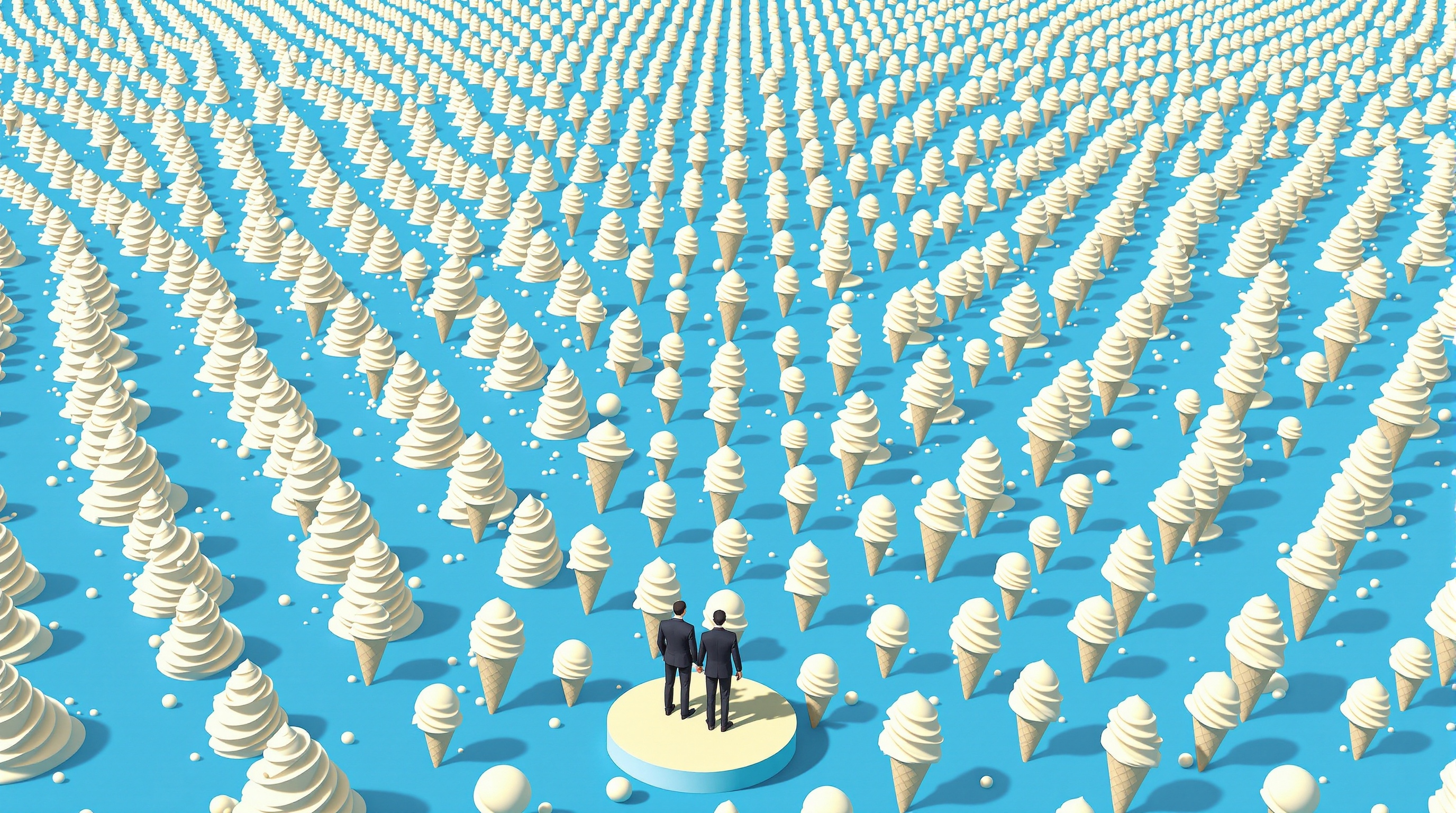

In the business software world, there’s an old joke that SaaS (Software as a Service) is like vanilla ice cream to private equity firms – predictable, consistent, and always following the same familiar recipe. This predictability made SaaS companies highly attractive investment targets throughout the 2010s and early 2020s. The model was simple: charge per seat, lock customers into annual contracts, deliver standardized solutions with minimal customization, and enjoy the steady, predictable revenue streams that investors craved.

But something fundamental is changing

The Vanilla Ice Cream Model is Melting

The traditional SaaS pricing model that investors found so appealing is under significant pressure. This isn’t just an incremental shift – it’s a structural transformation driven by several forces converging at once:

- AI-powered alternatives are giving customers increased leverage and options

- Rising expectations for customization that standard products can’t satisfy

- New pricing paradigms that challenge the per-seat subscription model

- Changing valuation metrics for what constitutes “quality” revenue

Let’s consider how these forces are reshaping the landscape.

From Mass Production to Mass Personalization

The vanilla ice cream SaaS model thrived on standardization. Every customer got essentially the same product with minor configuration differences, enabling providers to maximize margins through economies of scale. It was the software equivalent of Henry Ford’s assembly line – efficient, predictable, and decidedly uniform.

But AI is enabling something different: cost-effective mass personalization.

Companies increasingly expect solutions tailored to their specific needs, and with AI, providers can actually deliver this without destroying their margins. However, this shift fundamentally changes the nature of SaaS from a pure product business to a hybrid product-service model.

In our advisory work at The Kernel, we’re seeing this play out across client engagements. Organizations that previously accepted one-size-fits-all solutions are now demanding bespoke implementations, knowing that AI makes these customizations economically viable for providers to deliver.

The Pricing Revolution: From Seats to Outcomes

Perhaps the most disruptive aspect of this transformation is how it’s forcing a rethinking of SaaS pricing models.

The per-seat subscription model worked beautifully in the pre-AI era. It was simple to understand, easy to scale, and created predictable revenue forecasts that investors loved. But as AI enters the equation, this model shows significant strains:

- When AI agents can replace multiple human users, per-seat pricing becomes problematic

- When value comes from outcomes rather than access, subscription models seem disconnected

- When customization increases, uniform pricing seems increasingly arbitrary

This is leading to experimentation with new pricing approaches:

1. Outcome-Based Pricing

Rather than charging for access to software, companies are beginning to price based on measurable business outcomes. This aligns provider incentives with customer success but creates less predictable revenue streams.

2. AI-Powered Dynamic Pricing

Here’s where things get really interesting. What if the solution to AI’s disruption of SaaS pricing is… more AI?

Advanced AI systems could analyze each customer’s unique situation, usage patterns, value received, and ability to pay, then generate truly personalized pricing structures for each client. This would represent a radical departure from the standardized pricing tiers most SaaS companies employ today.

In our Labs division at The Kernel, we’ve been exploring how AI-driven pricing engines could create win-win scenarios – customers pay based on their specific value realization, while providers capture appropriate value without leaving money on the table or pricing customers out.

The technology to enable this exists today. The question is whether SaaS companies will embrace this level of pricing sophistication or stick with simpler models at the risk of competitive disadvantage.

Investment Implications: From Vanilla to Gelato

For investors accustomed to the simplicity of vanilla ice cream SaaS businesses, this new world of customized solutions and dynamic pricing represents a significant change. However, the modern AI-native SaaS landscape is more akin to a rich and layered gelato or a bold sherbet that is full of unexpected flavor combinations and depth. These newer models come packed with dense content, intricate textures, and greater options, but they also call for a more nuanced approach to diligence and valuation. Revenue becomes less predictable, margin profiles more variable, and valuation methodologies more complex.

This doesn’t mean SaaS businesses become uninvestable – far from it. But it does mean investors need new frameworks for evaluating these companies. The metrics that worked for the 2010s SaaS boom won’t capture the value creation potential of AI-native SaaS companies with more sophisticated business models.

In our advisory practice, we’re already guiding companies through this transition, helping them develop pricing strategies that balance predictability with flexibility, standardization with customization. The winners will be those who embrace this new paradigm rather than clinging to outdated models.

The Future: Adaptive Business Models

The most successful next-generation SaaS companies will likely adopt hybrid approaches:

- Core products with standardized pricing for basic functionality

- AI-enhanced customization layers with outcome-based pricing

- Value-based pricing determined by AI algorithms analyzing usage and impact

- Flexibility to adapt pricing as customer needs evolve

This won’t be easy to implement, but it will create more resilient business models that can thrive in the AI era.

Conclusion: From Recipe to Relationship

The vanilla ice cream era of SaaS is ending. We’re entering a time where software providers must develop deeper, more nuanced relationships with their customers, understanding their specific needs and demonstrating clear value rather than simply selling access to standardized solutions.

For SaaS companies, this requires rethinking fundamental aspects of their business models. For customers, it creates opportunities to demand solutions truly tailored to their needs rather than adapting their processes to fit standardized software.

And for those of us working at the intersection of business strategy and technology implementation, it creates a fascinating new landscape where the old rules are being rewritten and new possibilities emerge daily.

The future of SaaS isn’t vanilla ice cream. It’s a customized dessert crafted precisely to each customer’s taste, with pricing that reflects the unique value delivered. That’s messier than the old model, but potentially far more satisfying for everyone involved.

About The Kernel

Headquartered in Charleston, South Carolina, The Kernel is a unique advisory firm serving emerging technologies, global enterprises, and capital providers. Founded by a team of veteran technologists and investment management professionals, The Kernel is united by a mission to drive growth through innovation. With a proven model of identifying, validating, deploying, and investing in emerging technologies, The Kernel consistently delivers successful outcomes for its enterprise clients and capital partners. Learn more at https://thekernel.io.